Florida cities on front lines of sea level rise adopt Gridics platform to help visualize zoning changes.

For Immediate Release: September 25, 2019

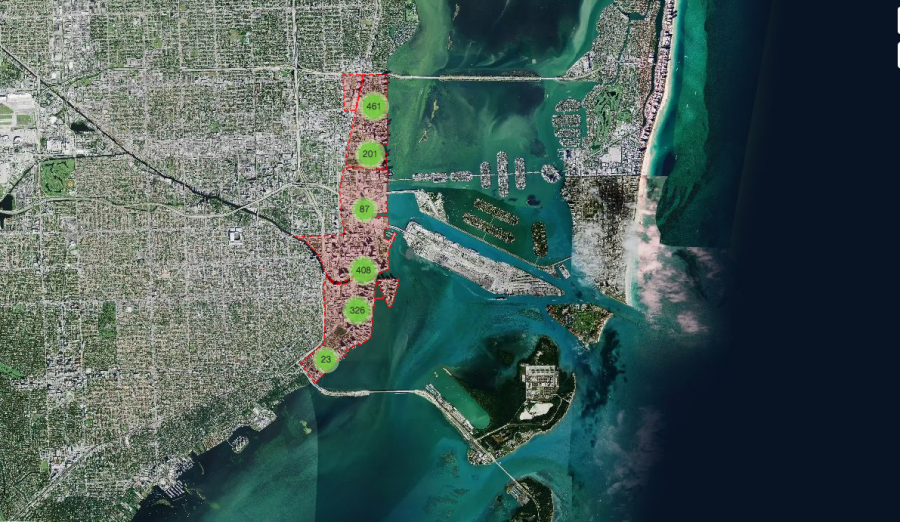

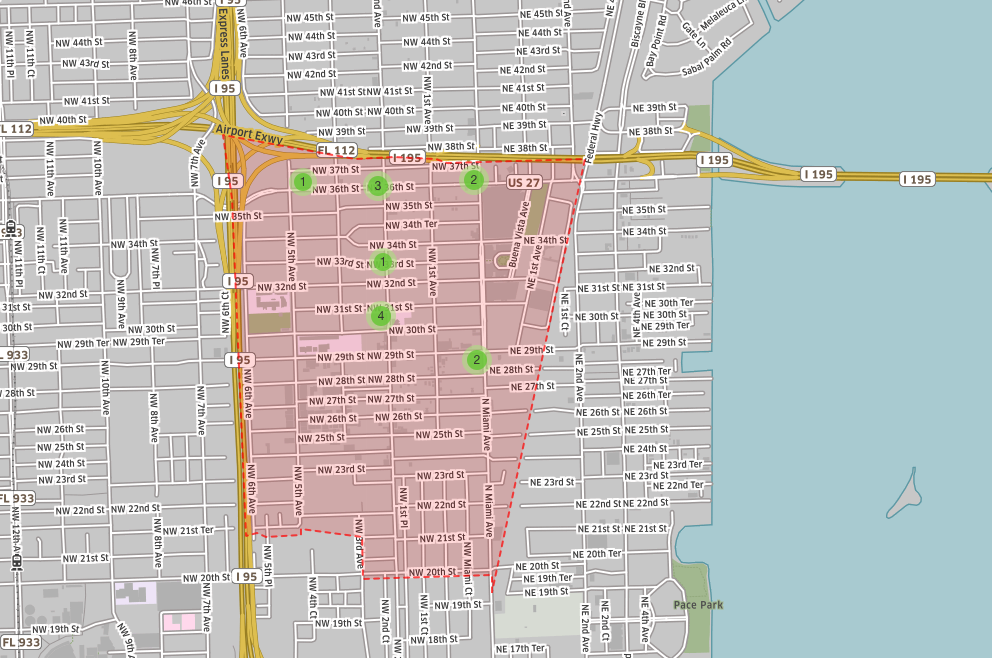

Miami, FL – Gridics LLC, a real estate tech and data company, today announced the City of Miami Beach and Bal Harbour Village are the latest Florida cities to adopt the Gridics 3D zoning map, text and property data platform to bring simplicity, transparency, and efficiency to what can otherwise be a very complicated process for city planners and residents trying to understand zoning code changes and potential.

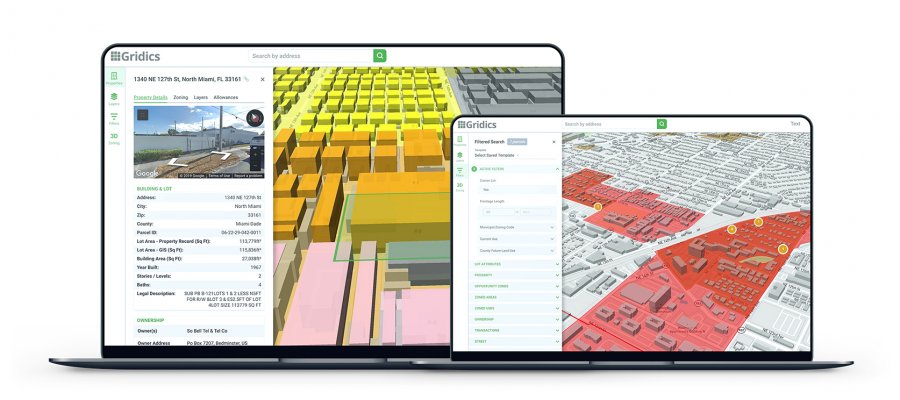

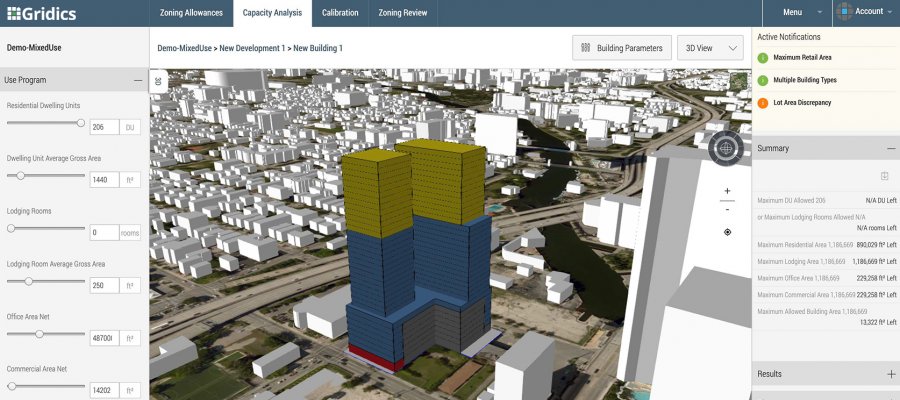

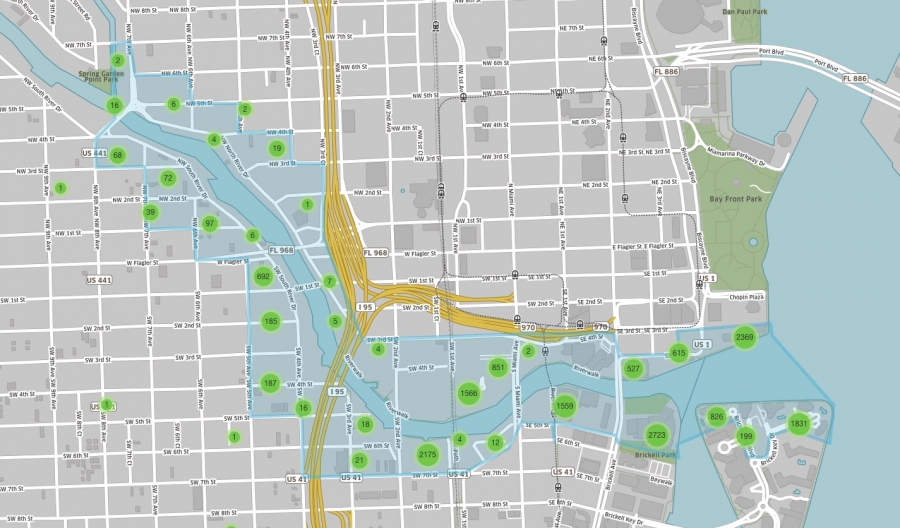

Gridics helps municipalities in three ways. First, a unified 3D interactive map and zoning code website allows municipal staff and citizens to visualize the buildable capacity of every parcel as allowed by zoning and publish code text changes in real-time. Second, online property lookup tools deliver deep, parcel-specific zoning data to help citizens get answers to common zoning questions which significantly reduces phone calls and in-person visits to the planning staff. Third, municipal staff members can easily run 3D scenario analysis of current zoning allowances, visualize proposed zoning changes and more quickly check permit applications and development plans for compliance.

For low-lying coastal communities like Miami Beach and Bal Harbour grappling with sea level rise and the broader impact of climate change on their built environment, zoning changes are a key piece of the solution puzzle.

“Gridics has developed cutting edge technology that facilitates analysis of a city’s zoning ordinance and allows for the visualization of changes in a built environment. The technology provides transparency to the public as the community and elected officials consider the benefits and impacts of proposed projects. Additionally, having zoning text and zoning map integrated allows the city to update its zoning ordinance quickly and efficiently.” Said Carmen Sanchez, Deputy Planning Director Miami Beach.

The Gridics platform aims to make it easier for citizens, investors and developers to do business and interact with municipalities by bridging the communication gap that the existing municipal zoning text publishing and mapping tools perpetuate. This ranges from large initiatives such as helping citizens and elected officials to visualize proposed zoning changes to more everyday processes like reducing the time staff spends servicing basic zoning questions both in person and via phone.

“We’re thrilled to add Miami Beach and Bal Harbour to the Gridics municipal network” said Jason Doyle CEO of Gridics. “Our team of urban planners and software engineers are passionate about helping to build better cities and that starts with progressive and innovative municipal partners focused on leveraging the latest technology and tools to make them easier to work with.”

Other Florida jurisdictions that have adopted Gridics include Miami, Fort Lauderdale and North Miami to name a few.

About Gridics: Gridics develops real estate data and software applications in the area of real estate development analysis and interpretation. For more information, visit www.gridics.com.